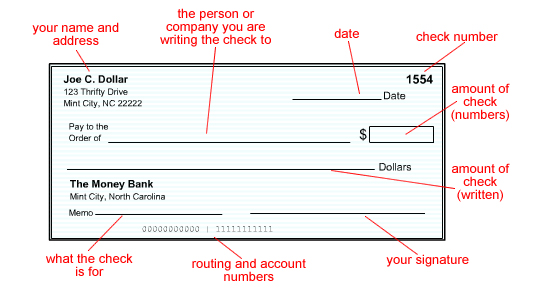

With both of these pieces of information, someone can potentially use them to withdraw money, pay their own bills, purchase items online from vendors, or set up a new account using your funds-all from your checking account. While someone cannot hack your account directly using only your bank’s routing number, a carelessly disposed physical check can compromise your bank account because personal checks contain both your routing and account number. The Difference Between Routing Number and Account Numbers In some cases, they will ask you to provide a voided check to ensure the money goes directly into your account. If you are making electronic payments online to save money, signing up for direct deposit with your employer, or accepting money transfers from someone to your bank account, they will need the routing number on a check. While you may be tempted never to give someone your routing number, there are a few instances where it is necessary.

#Checkbook routing number and account number registration

Accuity is the company responsible for the registration of the more than 26,895 routing numbers assigned to banks. Banks can have up to five routing numbers for internal use, and some websites list ABA numbers for every bank doing business in the United States. Banks may have more than one routing number because of mergers, branches in different states, or other special circumstances. These 9-digit numbers are assigned by the American Banking Association (ABA) to each bank. Routing numbers are also called ABA Routing Numbers.

0 kommentar(er)

0 kommentar(er)